By Spear News

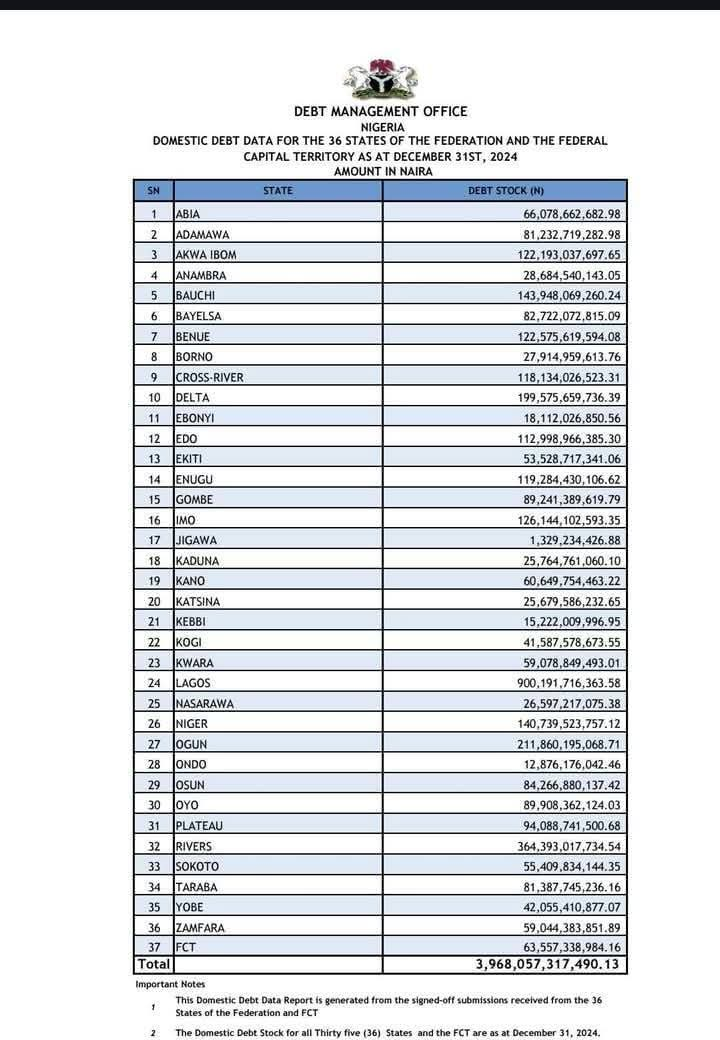

A newly released report from Nigeria’s Debt Management Office (DMO) has laid bare the financial health of all 36 states and the Federal Capital Territory (FCT), showing a dramatic ₦1.85 trillion reduction in domestic debt within just 18 months, Spear News reports.

According to the data, while some states significantly slashed their borrowings, others, including Lagos, Rivers, and Ogun, remain at the top of the debtors’ chart, raising concerns over fiscal sustainability.

The DMO’s figures, covering June 2023 to December 2024, reveal that Lagos State, Nigeria’s economic powerhouse, still carries the heaviest debt burden at N900.19 billion.

However, this marks a slight decrease from N996.44 billion in mid-2023, suggesting cautious debt management.

However, Rivers State presents a concerning exception, increasing its debt by a staggering N138.88 billion (61.6%) during the same period. This dramatic rise contrasts sharply with the national trend and raises questions about the state’s fiscal strategy.

Other major debtors like Lagos and Ogun showed more modest reductions of ₦96.25 billion (9.7%) and ₦81.34 billion (27.7%) respectively.

Ogun State, another major debtor, reduced its obligations from N293.20 billion to N211.86 billion, a N81.34 billion drop.

Delta State recorded the most impressive decline, cutting its debt by a staggering N265.82 billion (57%), from N465.40 billion to N199.58 billion—a move that could signal strong fiscal discipline or federal support.

At the other end of the spectrum, Jigawa State emerged as Nigeria’s least indebted, with a remarkably low N1.33 billion debt, a rare case of fiscal restraint. Ebonyi (N8.11 billion) and Kebbi (N15.22 billion) also ranked among the most financially prudent states, alongside Borno (N27.91 billion) and Kaduna (N25.76 billion), despite facing security challenges.

Discussion about this post