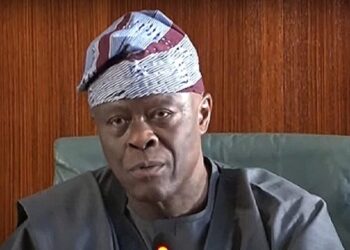

Governor Uba Sani has unveiled ambitious plans to bring two million more Kaduna residents into the formal banking system by December 2025, as the state intensifies its war against poverty through financial empowerment.

Addressing attendees at Wednesday’s Kaduna Economic and Financial Inclusion Summit (KEFIS 2025), the governor revealed the state had already made significant progress – with 2.5 million new accounts opened and nearly seven million citizens now registered with National Identification Numbers (NIN) to streamline financial access.

Financial inclusion isn’t just about bank accounts – it’s the foundation for economic mobility and lifting families out of poverty, Sani told delegates at the summit themed *’Expanding Financial Access for Sustainable Development’ The initiative builds on Kaduna’s existing digital infrastructure, including its robust NIN enrolment figures which outpace many other states.

“True financial inclusion is about granting individuals and communities the means to participate meaningfully in the economy, break the cycle of poverty, and elevate their quality of life,” he said.

According to Governor Sani, about 3.5 million people in Kaduna were outside the financial system as of 2023, hindering economic growth and leaving many vulnerable groups disenfranchised.

He, however, noted that his administration has made significant progress in promoting financial inclusion through various initiatives.

The governor highlighted the impact of the Banking and Other Financial Institutions Act (BOFIA) 2020, which brought fintechs under Central Bank regulation, enabling digital financial services to reach underserved areas.

“A lot has happened since fintechs came under the CBN’s regulatory oversight,” he said, adding that they are now reaching people formerly outside the financial system.

He also noted that the Kaduna State Financial Inclusion Executive Order has led to the formation of a state committee and targeted interventions.

He added that under the current administration, over ₦18bn has been channelled into accounts through direct cash transfers and input distribution by agencies like the Kaduna State Enterprise Development Agency (KADEDA), the Kaduna State Social Investment Programmes Agency (KADSIPA), and the Planning and Budget Commission.

According to him, the policy has resulted in a 19 per cent increase in financially served adults, rising from 45% in 2022 to 64 per cent in 2024.

“The signing of the Financial Inclusion Order in 2023 marked a significant moment in our journey toward economic empowerment and social equity,” Sani said.

Sani also emphasised the importance of supporting Micro, Small, and Medium Enterprises (MSMEs) in job creation and economic growth.

“We are fostering a vibrant entrepreneurial ecosystem where MSMEs can grow, create employment opportunities, and contribute to the economy of Kaduna State,” he said.

The governor attributed the progress made in financial inclusion to partnerships with banks, fintechs, and global development partners like the Gates Foundation.

“The Gates Foundation is streamlining NIN enrollment and supporting digital payment systems,” he said.

He noted that Kaduna has been chosen as a pilot state for a national financial inclusion initiative and will allocate 5,000 hectares for an in-grower scheme to support rural farmers.

“This approach is tailored to empower rural communities and integrate them into the formal financial system,” he said.

With these efforts, the governor expressed confidence that Kaduna State will continue to make significant strides in reducing poverty and promoting economic growth through financial inclusion. ENDS.

Discussion about this post