The Nigerian Upstream Petroleum Regulatory Commission (NUPRC) has reiterated plans to raise the active oil rigs in Nigeria’s petroleum sector from the current 36 to 50 by the end of 2025, an increase of about 38.89 per cent.

Also yesterday, it emerged that global oil giant, Shell Plc, paid $5.34 billion in taxes and other charges to Nigeria in 2024, more than any other country it operates in the world, a Bloomberg news report said.

In the same vein, Seplat Energy Plc, one of Nigeria’s largest oil and gas explorers, has said it expects first-half revenue to exceed last year’s $1.1 billion after ramping up production this year.

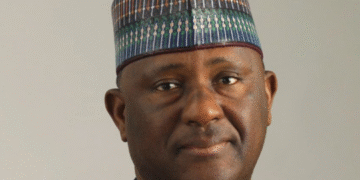

But speaking at the just concluded 2025 Africa Energies Summit (AES) in London, United Kingdom, the Chief Executive of the NUPRC, Gbenga Komolafe, noted that from eight oil rigs in 2021, President Bola Tinubu’s recent reforms have significantly removed the bottlenecks and enhanced investment in the country’s oil sector.

The number of active oil rigs is a key indicator of the level of activity in the oil and gas sector, reflecting how much exploration and production work is currently underway. Each active rig represents an investment by an oil company to either discover new oil reserves or extract oil from known fields.

Komolafe, who spoke on the theme: “Igniting Nigeria and Africa’s Energy Future: Evolving Landscapes, Challenges, and Transformative Opportunities”, told the global audience at the event that Nigeria is now well positioned to tap into the projected $600 billion annual upstream investment required to grow Africa’s oil sector, estimated to hit about $3 trillion by 2030.

Quoting the International Energy Forum (IEF), the NUPRC chief executive pointed out that Africa’s energy need is projected to rise by 30 per cent by 2040, noting that to meet the projected demand, Nigeria has continued to play its part to attract the right investment to the sector.

“Africa’s own energy demand is poised to surge by 30 per cent by 2040, driven by rapid population growth, industrial ambition, and the rightful quest for universal energy access. Meeting this demand sustainably will require over $600 billion in upstream investments annually through 2030, according to a study conducted by the International Energy Forum (IEF) last year,” Komolafe said.

According to him, through the recent Presidential Executive Orders and the proactive stance of the NUPRC, Nigeria has redefined itself not only as a land of vast hydrocarbon potential but as a destination where opportunity meets ease of doing business, certainty, and investor value.

“The transformative impact has been remarkable. Our oil and gas sector has seen a significant surge in investment. New investors, empowered by clarity and quality, have entered our sector, oil and gas reserves and production have increased, while rig counts have surged from 8 in 2021 to 36 currently, with projections to reach 50 by the end of the year.

“This momentum reflects a bold new chapter; one driven by ambition, resilience, and opportunity. With 210.54 trillion cubic feet of natural gas reserves, the largest in Africa, and 37.28 billion barrels of crude oil reserves, Nigeria holds enormous reserves.

“Our national production target is 3 million barrels per day but achieving this requires continuous investment to unlock new basins and mature frontier fields to secure future energy needs that will match our fast-growing population. Therefore, it is safe to say that Nigeria is a major force and the rallying point in hydrocarbon conversation in Africa,” Komolafe added.

On recent licensing initiatives, the NUPRC boss explained that each of the awards and rounds was conducted with unprecedented transparency, unmatched competitiveness, and remarkable investor engagement.

Besides, Komolafe stated that the NUPRC has repositioned Nigeria as a prime destination for oil and gas investment, while reaffirming its commitment to global standards of excellence, innovation, and partnership.

Highlighting the quality and accessibility of subsurface data in the country, he disclosed that through a landmark partnership with TGS-PetroData and other multi-client service providers, the NUPRC embarked on one of Africa’s most ambitious data acquisition and reprocessing campaigns, acquiring over 11,000 square kilometers of 3D seismic data as part of the broader 56,000 sq km Awalé project.

At the heart of the revolution, he said, is also Nigeria’s National Data Repository (NDR), which houses one of the most extensive seismic databases on the continent and records from over 10,000 wells, enabling both physical and remote access for thorough technical due diligence.

“This wealth of accessible, high-quality data has not only empowered investor confidence during recent bid rounds but has firmly repositioned Nigeria as one of the most data-rich and investment-ready destinations in the global energy landscape,” Komolafe said.

He reiterated that the Nigerian oil and gas industry stands as the very heartbeat of the nation’s economy, contributing an astounding 95 per cent of foreign exchange earnings and nearly 70 per cent of government revenue, while creating jobs and establishing Nigeria as a strong player in the global energy landscape.

But he argued that if Nigeria is to sustain, accelerate, and truly harness the full potential of the sector for future generations, it must remain steadfast in advancing strategic initiatives that maximise government revenue, deliver tangible economic benefits to over 200 million Nigerians, and ensure consistent, attractive returns for valued investors.

To further consolidate the nation’s drive for energy security and production resilience, the NUPRC, he said, launched the bold and visionary initiative known as ‘Project 1 Million Barrels per Day (1MMBOPD)’.

According to him, at the centre of this initiative lies a propelling goal to increase Nigeria’s crude oil production by over 1 million barrels per day, in the mid-term, beyond the October 2024 baseline.

“This initiative was not conceived in abstraction, but in the context of real opportunity. It is a call to every oil and gas operating company, partners, and investors to revitalise dormant fields, rejuvenate brownfields, and deliver on the promise of existing assets in line with good asset stewardship,” he emphasised.

Since the launch of the project, he stated that Nigeria has achieved a notable increase in daily production, recently reaching 1.78 million barrels per day, up from a baseline of 1.46 million barrels per day in October 2024.

“Our message to you is therefore simple and resolute: Nigeria is not only rich in natural resources; it offers a strategic landscape of high-yield opportunities for forward-looking investors,” Komolafe said.

Also, Global oil giant, Shell Plc, paid $5.34 billion in taxes and other charges to Nigeria in 2024, more than any other country it operates in the world, a Bloomberg news report said yesterday.

The company’s payments to Nigeria increased from the previous year and came as the oil and gas company is on the verge of leaving Nigeria’s onshore production business after many decades of controversial operations.

Shell, which released the figures in a disclosure required under UK law, will continue to produce oil in the waters off the west Africa nation, the report stated.

Exiting onshore production in the Niger Delta, which is among Shell’s most emissions-intensive operations where the company is accused of causing widespread environmental pollution, is part of its effort to simplify its portfolio and “become a net-zero energy business by 2050,” the company said.

Besides, Oman, Brazil and Norway, where Shell has significant operating footprints, were next on the payments list after Nigeria and together received approximately $11.7 billion. The report published on Thursday covers charges related to extractive activities.

In the UK, the government refunded Shell about $32 million for decommissioning the Brent field and other North Sea production assets, down from a $43 million refund for those assets in 2023.

Since this report only includes extractive activities charges, this does not represent Shell’s total tax bill to the UK. The last disclosed payment from Shell to the UK government was about $6 billion in 2023, which was published at the end of 2024.

Overall, Shell paid governments around the world about $28.1 billion in taxes and charges related to its extractive activities in 2024, down nearly 5 per cent from 2023. Shell’s full year adjusted earnings in 2024 were $23.7 billion, a roughly 17 per cent decline from 2023.

Meanwhile, Seplat Energy Plc, one of Nigeria’s largest oil and gas explorers, has said it expects first-half revenue to exceed last year’s $1.1 billion after ramping-up production.

“Our revenue last year was $1.1 billion. In the first quarter, our revenue was $809 million, so in the second quarter, it will likely exceed the total revenue for all of last year,” Bloomberg quoted Chief Executive Officer, Roger Brown, as telling investors at an annual general meeting in Lagos.

Seplat has seen a significant boost in production since acquiring assets from the Nigerian unit of Exxon Mobil Corp late last year. It predicted at the time that the deal could nearly triple output to more than 200,000 barrels a day.

To guard against a global oil slump, Seplat has hedged 5 million barrels of crude per quarter at $55 a barrel and initiated cost controls to protect the business, Brown said.

US trade tariffs and higher Organisation of Petroleum Exporting Countries (OPEC) output have caused oil prices to fall 11 per cent this year to $66.27 per barrel.

The hedging allows Seplat to sell crude at the predetermined price and volume in 2025, even if oil prices fall below the threshold, the report added.

Meanwhile, President of the Senate, Godswill Akpabio, has reiterated the commitment of the National Assembly to tackle crude oil theft, stressing that the legislature was considering stiffer penalties for oil theft, including terrorism charges for major offenders.

Akpabio disclosed this while declaring open a two-day public hearing on the incessant and nefarious acts of crude oil theft in the Niger Delta and the actors at the Senate wing of the National Assembly.

Represented by the Deputy President of the Senate, Senator Barau Jibrin, he said the 10th National Assembly will not stand by while the country’s economy bleeds.

He said: “We are prepared to strengthen laws, enhance oversight, and ensure that agencies responsible for protecting our oil assets are held accountable. Specifically, we will consider: Stiffer penalties for oil theft, including terrorism charges for major offenders.

“Mandatory digital metering and real-time monitoring of all oil production and exports. Greater transparency in crude oil lifting and revenue reporting. Enhanced collaboration between the military, police, NSCDC, EFCC, and international partners to track and intercept stolen crude.”

He said the fight against crude oil theft cannot be left to the government alone as such oil companies must invest in modern surveillance technology and secure pipelines.

According to him, host communities must see themselves as first-line defenders of these assets, not victims or accomplices. He said security agencies must demonstrate zero tolerance for complicity.

He said: “As I declare this Public Hearing open, I charge all stakeholders to engage with the utmost seriousness. The recommendations from this session must lead to actionable, measurable, and time-bound solutions. Nigeria’s survival depends on it.

“To the criminals stealing our crude oil, your time is up. To the agencies tasked with protecting our resources, the nation is watching.

“To this Ad-hoc Committee, the Senate expects nothing less than a robust, no-holds-barred report that will guide decisive legislative and executive actions. It is time to take back what belongs to Nigeria,” he said.

He commended the Senate Ad-hoc Committee on Incessant Crude Oil Theft, chaired by Senator Ned Munir Nwoko (Delta North), for convening the public hearing

He said: “Nigeria’s oil and gas sector remains the lifeblood of our economy, accounting for over 80 per cent of government revenue and 90 per cent of foreign exchange earnings. Yet, for decades, we have watched in dismay as criminal syndicates – both foreign and domestic – continue to siphon our crude oil with brazen impunity.

“Recent reports indicate that Nigeria loses between 150,000 and 400,000 barrels of crude oil per day to theft – a staggering hemorrhage that translates to billions of dollars in lost revenue annually.

“This theft is not a victimless crime. It directly undermines our economic stability, devalues the Naira, starves critical sectors of funding, and perpetuates poverty in oil-producing communities.

“Worse still, it finances illegal arms, fuels violence, and emboldens criminal networks that threaten national security. Let me be unequivocal, crude oil theft is an act of economic sabotage and must be treated as such.

“Those behind this criminal enterprise are enemies of the state, and they must be pursued, prosecuted, and punished to the fullest extent of the law. We can no longer tolerate a situation where a few greedy individuals and cartels hold our nation’s wealth hostage while millions of Nigerians suffer.

“While previous efforts have been made to curb this menace, the persistence of oil theft suggests systemic failures that require immediate and decisive action. This Public Hearing must address key questions: Who are the perpetrators? Are they militants, corrupt officials, international collaborators, or all three?

“Why have current surveillance and security measures failed? How are stolen crude oil shipments exported without detection? What legislative and policy reforms can close existing loopholes?

“We must also critically examine the roles of regulatory agencies, security forces, oil companies, and host communities in either enabling or combating this crime,” the President of the Senate stated.

Discussion about this post