The World Bank has approved a fresh $500 million loan to support Nigeria’s economic recovery efforts through its Community Action for Resilience and Economic Stimulus (CARES) programme.

The financing, approved on 28 March 2025, aims to strengthen food security and provide critical support for vulnerable households and small businesses facing economic hardship.

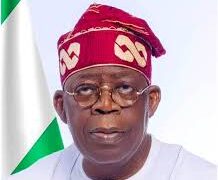

This latest intervention brings total World Bank loan approvals under President Bola Tinubu’s administration to $7.45 billion since taking office in 2023.

However, the approval comes alongside concerning data showing Nigerian banks lost N42.6 billion to fraud in just the second quarter of 2024 – surpassing total fraud losses recorded for the entire previous year. The timing highlights Nigeria’s dual challenges of securing international financial support while addressing systemic weaknesses in its financial sector.

The CARES programme will focus on direct grants to poor households, support for small enterprises, and community-level resilience projects.

While the new funding demonstrates continued international confidence in Nigeria’s reform agenda, questions remain about implementation capacity. Official data reveals only $774.99 million of an earlier $4.95 billion World Bank loan package had been disbursed as of July 2024, representing just 16% of approved funds.

Two additional loans worth $632 million combined – targeting nutrition and basic education – are expected for final approval this week. Nigeria’s total debt to World Bank institutions now stands at $17.32 billion, with the majority owed to the International Development Association.

Financial analysts note the paradox of increasing international support alongside growing domestic financial sector vulnerabilities. The N42.6 billion fraud losses in Q2 2024, which exceeded all of 2023’s losses, point to significant security gaps in Nigeria’s banking system even as the government seeks more external borrowing.

Economists stress that while the loans provide necessary fiscal breathing room, their ultimate impact will depend on improved implementation capacity and stronger financial sector oversight. The Tinubu administration faces mounting pressure to demonstrate it can effectively deploy international loans while addressing systemic issues like banking fraud that undermine economic stability.

With Nigeria’s economy still recovering from multiple shocks, the World Bank’s continued support remains crucial. However, the latest data suggests success will require not just additional funding, but better management of both public finances and financial sector risks moving forward.

Discussion about this post